Dorado Project Background

Carnarvon secured its interests in the Bedout Sub-Basin exploration permits (WA-435-P, WA-436-P, WA-437-P and WA-438-P) in 2009. The offshore permits cover an expansive area of 21,652km2 which is located approximately 110km from the coast, offshore of Port Hedland in Western Australia.

Historically, the Bedout Sub-Basin was significantly underexplored in comparison to the prolific Carnarvon Basin to the south-west and the Bonaparte Basin to the north-east. Exploration drilling within the area was limited to a string of wells in the 1970’s and early 1980’s. These included the Phoenix-1 and Phoenix-2 wells, which at the time were considered gas discoveries and were not pursued further. The unexplored potential across this vast area and the presence of hydrocarbons within the region, led to Carnarvon’s initial interest in the basin.

Carnarvon’s preliminary work on the permits involved extensive geological studies and the acquisition of modern 3D seismic data which was a marked upgrade to the existing legacy 2D seismic. The 3D seismic acquisition confirmed two significant prospects in Phoenix South within WA-435-P and Roc in WA-437-P. As a result, interest in the permits grew and the Bedout Joint Venture farmed out equity in the project to new partners who funded exploration drilling costs to test the Phoenix South and Roc targets.

The Phoenix South-1 well was drilled in 2014, discovering light oil within an effective reservoir. This was followed by the discovery and appraisal of a condensate rich gas in the Roc field. The Roc-2 appraisal well also included a historic flow test, confirming the ability of the hydrocarbons to flow from the quality Caley Member reservoir. These results proved to be the catalyst for this region which warranted further exploration.

In 2018, the Dorado-1 exploration well discovered a significant light oil column in the primary Caley Member, and condensate rich gas in four additional reservoirs. The subsequent appraisal of the Dorado discovery was successfully completed with the well test results exceeding pre-test expectations and confirming the high quality nature of the reservoirs in Dorado. Dorado is a world class discovery which has ignited interest in the Bedout Sub-basin and has proven to be transformational for the Company.

Further success in the basin was realised in 2022, as the Pavo-1 exploration well discovered a 60m gross, undersaturated light oil column in excellent Caley Member reservoir. Importantly, the discovery, which is located 46km east of Dorado, validated the effectiveness of the Caley Member play extent to the East and now provides a valuable back-fill option to the proposed Dorado facilities.

Dorado Development (WA-64-P)

(Carnarvon 10%, Santos is the Operator)

The Dorado Field is located approximately 150km north of Port Hedland in the Bedout Sub-basin with water depths of approximately 90m.

Discovered in 2018, Dorado is the largest undeveloped liquids field in Australia consisting of five separate light oil and rich gas condensate accumulations, with high quality hydrocarbon fluids within excellent quality reservoirs.

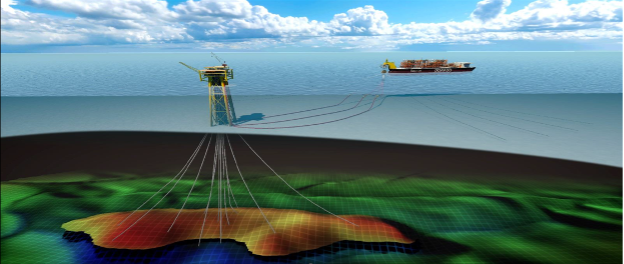

The selected concept for the Dorado Phase 1 liquids development is based on production from a fixed wellhead platform (WHP) connected to a Floating Production, Storage and Offtake (FPSO) vessel, which handles oil and condensate stabilisation, storage and offloading, water treatment for disposal, gas dehydration, gas compression and reinjection (Figure 3). During the Phase 1 development, gas is injected back into the reservoir to enhance oil and condensate production, with the remaining gas stored for later extraction as part of the future Phase 2 gas export development.

In August 2023, Carnarvon completed the divestment of a 10% interest working interest in its Bedout assets to OPIC Australia Pty Limited, its ultimate holding company being CPC Corporation, Taiwan (CPC), Taiwan’s national oil and gas company.

Under the agreement, Carnarvon will receive a total cash consideration of US$148 million. This includes the upfront payment of US$58 million, with the remaining US$90 million as a carry on Carnarvon’s future expenditure on the Dorado development and Bedout permits, once FID has been sanctioned for the Dorado development.

The partial divestment brings another high-quality partner to the project in CPC, and means Carnarvon is well positioned to fund its share of the Dorado development.

During the period, the Joint Venture completed a revision of the Dorado project design, to improve the economics through optimised utilisation of the proposed production facilities. The key optimisation opportunities focused on re-shaping the production rates to between 60,000 and 100,000 bopd, which allows for the rightsizing of the FPSO, WHP and other facilities as well as the phasing of development well placement. This reduction in the facility capacity is likely to reduce the overall CAPEX for the Phase 1 liquids development.

Furthermore, the revised capacity allows for phasing of the development wells by reducing the number of wells and the up-front capital expenditure required prior to first oil. Any remaining wells would be drilled during production allowing them to be self-funded through project cash flows. These opportunities could considerably improve the project’s value and returns by reducing both the up-front capital outlay and the time to first oil.

Through the optimisation process, the Joint Venture is also assessing FPSO vessel redeployment options along with other donor hulls for FPSO conversion. Dependent on the suitability and availability of these units, there could be further cost savings and opportunities to reduce the time to first oil for the Project above those already outlined.

Figure 3: Schematic of potential Dorado FPSO and WHP

Given the impact on engineering design and cost of utilising this potentially lower cost option, FEED re-entry is dependent on the ability to secure the best option vessel or hull. Importantly, any design changes would be within the scope of the approved Offshore Project Proposal (OPP). This allows the Operator to update the previously completed FEED work with FEED re-entry targeted for later this year and a Final Investment Decision (FID) in 2025.

Carnarvon estimates that the overall CAPEX prior to first oil will be below the previous guidance of ~US$2 billion (refer to STO ASX announcement on 16 February 2022). Carnarvon expects that the Company, with its strong balance sheet, the US$90m development cost carry and a prospective debt facility, will be fully funded for its share of development.

Along with the engineering and design work to allow the Dorado Phase 1 liquids development project to enter FEED prior to the end of the year, the Joint Venture commenced work on the vital drilling and development Environment Plans (“EP”) that are required to progress the project. While a Production License was secured in 2022, and an Offshore Project Proposal was accepted by the regulator in 2023, individual EPs are required to execute certain works in the field, and the Joint Venture has expressed a desire to materially progress these prior to FID. The necessary EPs for Drilling and Completion and WHP and SURF installation are in progress, with the external consultation work expected to be visible in due course.

Pavo Oil Discovery (WA-438-P)

(Carnarvon 20%, Santos is the Operator)

In 2022, the Joint Venture made another successful discovery with the Pavo-1 exploration well, which encountered a 60-meter gross oil column within the Caley Member. The oil column is wholly contained within the northern culmination of the Pavo structure (Pavo North) and is assessed to contain a 2C contingent resource of 43 million barrels of oil (mmbbls) gross (see page 14).

Importantly, the discovery, which is located 46 kilometres east of Dorado, provides valuable back-fill potential to the proposed Dorado facilities.

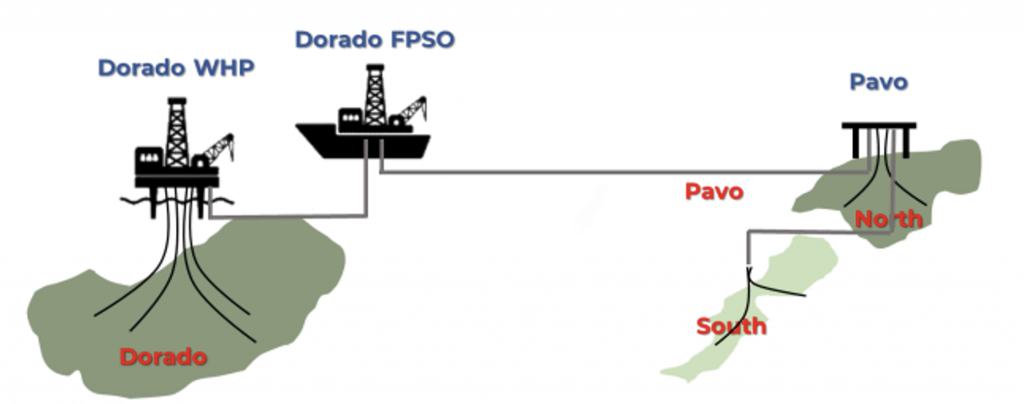

During the period, the Joint Venture completed the Pavo Assess subsurface and engineering study which confirmed that a WHP and sub-sea tieback to the Dorado facilities would be the most effective method to develop the Pavo North discovery (Figure 4). Static reservoir modelling of Pavo North and South has also been completed, which is an essential study to understand geological uncertainties in the reservoir that provides insights for in-place hydrocarbon volumes as well as reservoir performance.

Figure 4: Proposed Dorado Field Development Layout and tie-backs of Pavo North and Pavo South.

Further engineering studies have progressed including dynamic modelling to understand the likely production performance of the Pavo fluids based on well placement, as well as the integration of the Pavo fluids into the Dorado facilities.

The Joint Venture also submitted the Keraudren Extension Phase 3 3D seismic (KEP3) EP, which is currently out for public consultation. The KEP3D seismic acquisition is expected to commence from 2026 and will capture the Pavo North discovery and Pavo South appraisal target. Importantly, it will also provide an additional seismic acquisition azimuth for the Pavo development. Whilst the Pavo tie-back is a high value opportunity, based on the optimised Dorado production rates, tie-back of the Pavo resource to the Dorado facilities is not expected to be required for several years after Dorado production commences.

Exploration – Greater Bedout Area

(WA-435-P, WA-436-P, WA-437-P and WA-438-P)

(Carnarvon 10%-20% (Santos is the Operator)

The Bedout Sub-basin, offshore Western Australia, is one of Australia’s most exciting exploration plays. The Joint Venture’s exploration strategy has the potential to unlock substantial additional resources, with unrisked prospective resource estimates of 9 Tcf of gas and 1.6 billion barrels of liquids (Pmean, gross) (see page 18).

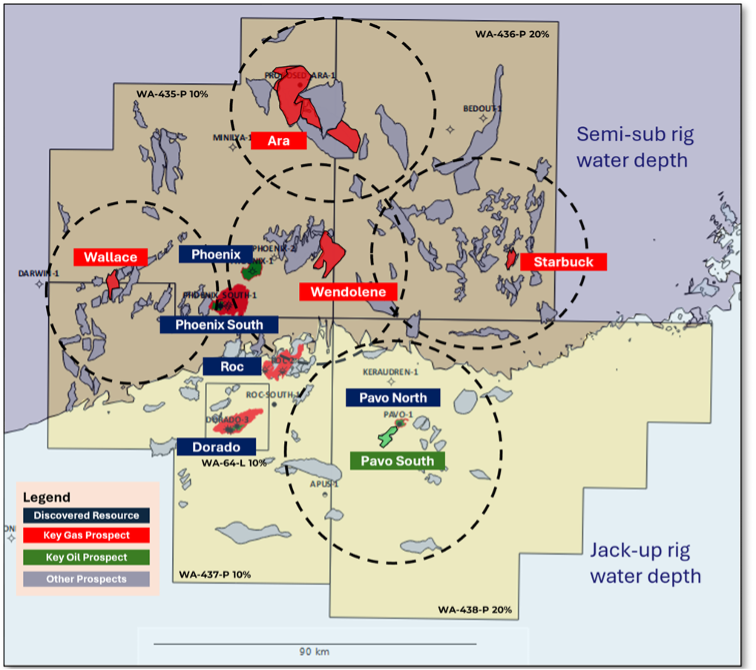

Within the extensive exploration acreage, five prospects have been highlighted for both their potential and their ability to unlock surrounding acreage – the Ara,Wallace, Wendolene, Starbuck and Pavo South prospects and are being high-graded for potential future drilling campaigns (Figures 5 and 6). These prospects have been strategically selected for their potential to build resource scale, de-risk significant prospectivity within nearby clusters and strengthen a number of development opportunities.

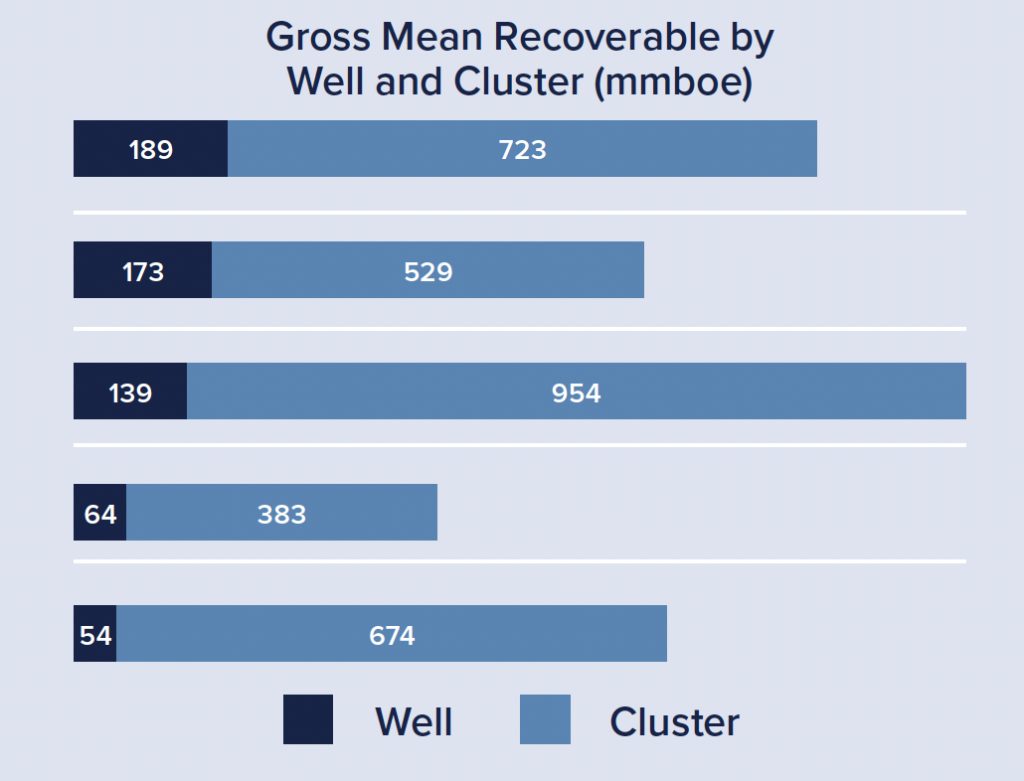

The five prospects contain a combined material resource of 623mmboe, comprised of 1.52Tcf gas and 352mmbl oil (Figure 5). Moreover, an additional 7.78Tcf and 1.25Bbbl (Pmean, gross) is estimated to be present in the exploration clusters delineated for tieback potential. This highlights the exceptional amount of identified exploration upside within Carnarvon’s exploration acreage, with such scale making it one of the most prospective exploration portfolios in Australia.

Figure 5: Bedout Prospect and Lead Map with key prospects and related tie-back clusters highlighted

Figure 6: Volumetrics of the five standout prospects and their respective cluster of nearby prospects.

Importantly, the four Bedout exploration blocks are substantially covered by modern 3D seismic data. Exploration drilling based on this modern data had resulted in an excellent 67% success rate, with 4 discoveries from 6 wells.

Recent exploration studies have concentrated on the exploration prospectivity in the northern blocks, particularly around the Ara prospect (figure 7), as this gasprone target has the potential to enhance the value for the Dorado Phase 2 gas export development.

Figure 7: Ara Archer Formation stratigraphic target. Image taken from the TGS Zeester Capreolus MC3D.

During the period, seismic interpretation of the ZeesterCap Reprocessed 3D seismic volume, particularly the Sand Probability Quantitative Interpretation seismic product, has helped further derisk the Ara Prospect and surrounding exploration cluster for reservoir and seal configurations at both target levels.

Success at a prospect such as Ara would considerably de-risk the surrounding portfolio. Based on Carnarvon’s seismic interpretation, the Ara prospect is expected to contain over 549 Bscf and 91 million barrels of condensate (Pmean, gross) (see page 16). The prospects in the immediate vicinity, which would be significantly derisked on drilling success at Ara, contain an additional 1.5 Tcf and around 260 million barrels of condensate (Pmean, gross) (see page 16).

The Company looks forward to returning to drilling as soon as practical and will provide further details on drilling timelines as plans progress.

Exploration success in this region has been underpinned by the acquisition and utilisation of modern 3D seismic. This continued during the period, as the Joint Venture progressed its 3D seismic interpretation on the Dorado Multi-azimuth (DORMAZ) 3D, ZeesterCap Reprocessed 3D seismic and Keraudren Extension Full Integrity (“FI”) 3D datasets. These surveys targeted the highly prospective Archer Formation, which includes the prolific Caley Member, the primary reservoir for the Dorado, Roc and Pavo discoveries, as well as multiple secondary reservoir targets.

The DORMAZ 3D is a merged final product of the Archer, Keraudren and Capreolus 3D seismic volumes, which in turn provides multiple azimuth imaging and the most accurate representation of the Dorado Field. Whilst the Keraudren Extension FI 3D seismic volume represents the final, high-quality version of the dataset.

The Keraudren Extension FI 3D volume covers the southern portion of the WA-436-P permit, which in addition to the Zeester MC3D over the northern sections, now provides contiguous seismic coverage over 97% of the permit. 3D seismic interpretation of the Keraudren Extension FI 3D is well advanced with the prospectivity of the WA-436-P permit significantly high-graded. The exploration permit currently holds the highest number of identified prospects (40 prospects) and the largest total recoverable volumes in the Bedout portfolio.

During the period, the Joint Venture also submitted its renewal program for the four Bedout exploration permits to the regulator. Due to significant activity above the required commitments and exploration spend over the initial period, the Joint Venture has been able to successfully extend the initial six-year exploration period to a total of fourteen years. The end of the initial period occurred in mid-2023, and hence the Joint Venture has submitted the required documentation to fulfil the renewal requirements and allow continuous exploration in all for exploration permits.